A SINGLE SOLUTION FOR COMPREHENSIVE OVERSIGHT

All-in-one enterprise compliance management solutions trusted by the largest financial services organizations, accessible for SMBs and growing firms.

-

Personal Trade Monitoring

Leverage powerful automated trade surveillance capabilities, integrate electronic feeds from top brokerage firms and automate trade entry from confirmations and statements.

-

Personal Securities Accounts

Automate and streamline the time-consuming supervision and reporting of personal securities accounts.

-

Gifts, Gratuities, and Contributions

Manage the submissions, approvals and tracking of gifts, business entertainment, noncash compensation and political contributions.

-

Outside Business Activities

Enable centralized management of OBA disclosures, attestations and amendments, as well as FINRA reporting, to reduce review time and streamline communication.

-

Compliance Questionnaires

Create, distribute and track annual compliance questionnaires, and other critical questionnaires integral to maintaining a strong compliance program.

-

Client Trade Supervision & Account Monitoring

Efficiently manage client trade supervision and account monitoring across brokerage, advisory, trust and direct business.

-

Securities Registration

Automate the securities registration process for advisors and representatives, ensuring compliance and streamlining operations.

-

Advertising Review

Advanced capabilities leverage AI technology to automate and streamline marketing compliance review and speed time to market while reducing non-compliance risk.

PLATFORM CAPABILITIES

-

Unified Data Repository

-

Common User Interface

-

API Integration with CRM and Marketing Systems

-

Self Service Tools

-

Complex Hierarchy Management

-

FINRA Integration

-

WORM Archiving / SEC 17(a)-4 Compliance

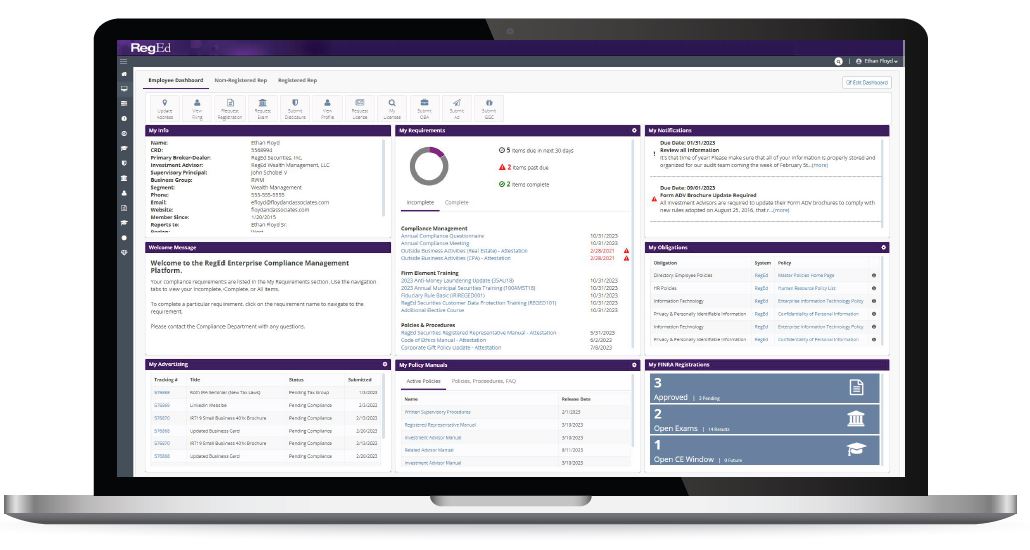

REGED EMPLOYEE COMPLIANCE DASHBOARD

Deliver a clear, comprehensive view into the status of compliance requirements at the company level or specific to the employee. This facilitates a full understanding of pending and upcoming compliance obligations, enabling users to prioritize fulfillment in alignment with critical deadlines.

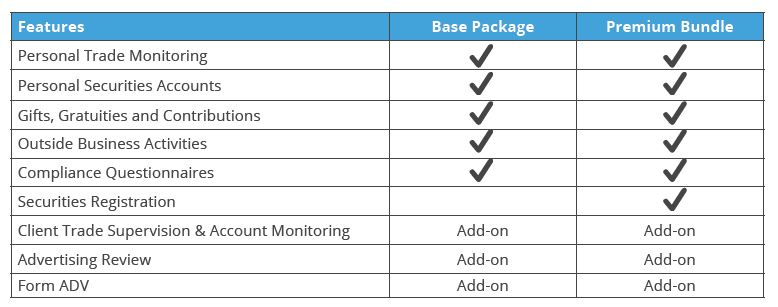

CHOOSE THE SOLUTION THAT FITS YOUR BUSINESS

COMPLIANCE CONTROL CENTER: RELATED RESOURCES

Content covering the latest news and best practices for compliance management, from industry and RegEd subject matter experts.

WHITE PAPER: Midsized Broker-Dealer Compliance Trends

RegEd conducted a survey to shed light on the compliance landscape among midsized broker-dealers within the U.S. financial services industry. In this white paper, we provide valuable insights into current trends and practices, serving as a benchmark for the industry and providing firms a resource to use in refining their own compliance strategies.

CELENT REPORT: Marketing Compliance in the Financial Services Industry

This report, authored by Neil Katkov, PhD, Head of Risk & Compliance at Celent, provides an overview of the different challenges faced by the financial services industry in regards to marketing and advertising compliance.

WEBINAR: FINRA, SEC and State Securities Enforcement Trends

FINRA, the SEC and state regulators have stepped up enforcement efforts in recent years, resulting in unprecedented sanctions. This panel of compliance and legal experts discuss these regulators’ enforcement priorities and methodologies, and examine lessons from recent cases and examination sweeps that shed light on how firms and their employees can avoid becoming the subject of an enforcement proceeding.

NEWS: RegEd’s Advertising Compliance Solution Surpasses 6 Million Submissions, Setting New Industry Milestone

RegEd today announced that Enterprise Advertising Review, an advanced technology solution that automates the advertising compliance review process, has processed more than 6 million submissions to date.

CONTACT US

Schedule a personalized consultation with our solution and subject matter experts. We’ll provide an overview of how RegEd’s enterprise platform enables our clients to improve efficiency, effectiveness and transparency across the enterprise.