|

By Amber Bird, Associate Product Manager, RegEd |

|---|

Complying with FINRA Rule 3220’s limitations can be challenging for broker-dealers, particularly large firms or those that have a high volume of transactions. Managing gifts, gratuities, and non-compensation across hundreds to tens of thousands of employees has evolved into a complex compliance management challenge that requires a consistent and methodical process for the submission, approval, and tracking of requests and their fulfillment.

While a single gift to a client may be within the organization’s accepted thresholds, multiple gifts or contributions over time to that same client could violate internal policies, or worse, result in a compliance breach. And with regulators making conflicts of interest a priority, violating FINRA Rule 3220 could result in fines or penalties for a firm, as well as reputational damage.

Firms often struggle to comply due to the lack of an effective process and supporting technology. For example:

- Tracking and reporting on the status of gifts and gratuities typically requires cumbersome data manipulation, often across multiple technology solutions (both internal and external).

- Supervising and tracking multiple contributions for the same event often requires repetitive data entry and is subject to errors.

- Determining and enforcing firm policy and threshold levels requires significant effort to ensure accuracy and efficiency.

- Relying on manual spreadsheets is inefficient, and can result in tracking errors and difficulty in reporting and analysis.

- Reviewers are unable to quickly view threshold status levels or identify potential violations efficiently without a system of automated alerts and visual indicators.

- Manual processes and forms can make the process difficult and cumbersome for financial professionals, preventing them from focusing on their core business-building objectives.

To ensure compliance, firms benefit from leveraging organization-wide procedures and technology to enable the efficient review, approval, management, and monitoring of gifts and gratuities submission requests against firm-defined thresholds, so that all submissions, regardless of the amount or point of origin, are tracked accurately.

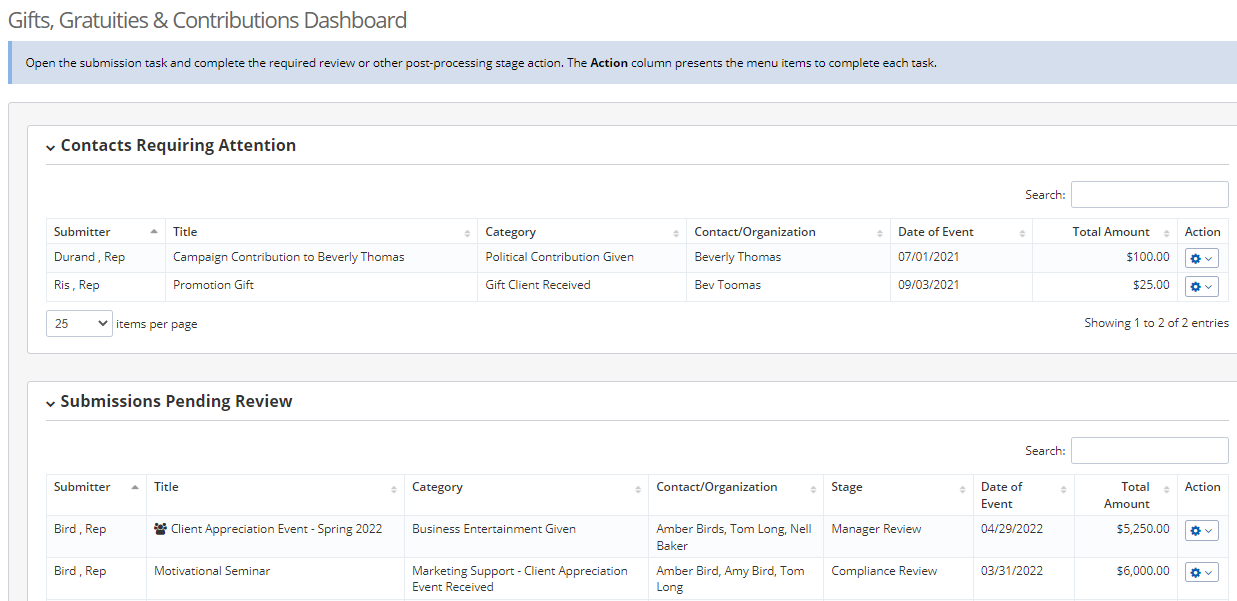

A technology solution that automates the tracking of gifts and gratuities given or received at the individual or firm level, such as RegEd’s Gifts, Gratuities and Contributions solution, can be particularly efficient and effective for reducing the risk of non-compliance for firms.

How does RegEd’s Gifts, Gratuities and Contributions solution help firms comply with FINRA Rule 3220?

FINRA Rule 3220 regulates the influencing or rewarding of employees of others. It does so in part by prohibiting a firm or a person associated with it from directly or indirectly giving “anything of value, including gratuities, in excess of one hundred dollars per individual per year to any person, principal, proprietor, employee, agent or representative of another person where such payment or gratuity is in relation to the business of the employer of the recipient of the payment or gratuity. A gift of any kind is considered a gratuity.”

RegEd’s Gifts, Gratuities and Contributions solution streamlines the end-to-end compliance process for registered reps and other persons who are subject to either regulatory or company policy.

In automatically aggregating totals for individuals and companies, Gifts, Gratuities and Contributions:

- Reduces review time and speeds decisions by enabling management by exception.

- Eliminates the need to track gifts and gratuities with spreadsheets, thereby improving efficiency and reducing the risk of errors.

- Relieves the financial professional of the burden of tracking their limits or what they have given and received.

- Allows reviewers to define policies for a period of time and manage risk proactively with a unified, enterprise solution that provides easy access to the information they require.

- Enables compliance managers and other stakeholders to holistically monitor the exchange of gifts, gratuities, contributions, and other non-cash compensation, track the pre-clearance approval process, supervise in compliance with firm policy, and identify limit violations.

How does RegEd’s Gifts, Gratuities and Contributions solution work?

To submit a gift, business entertainment, political contribution, or other non-cash compensation, whether given or received, submitters access the intuitive interface and enter details that their firm requires. The system then tracks and calculates the amounts against the firm-defined threshold policies.

Gifts, Gratuities and Contributions aggregates totals for employees, clients, and third parties. Compliance staff and other key stakeholders can view previous gifts or entertainment related to a specific recipient, individual giver, or multiple givers, to avoid exceeding contribution thresholds.

A firm defines the thresholds that they need to supervise when they implement the solution in collaboration with RegEd’s implementation team that leverages best practices from numerous enterprise client implementations. Experienced implementation specialists help ensure the policies are set up correctly and in line with firm policies. The firm then links those thresholds to specific submission categories:

- Totals can be aggregated in many ways, such as by submitter, contact, or organization.

- Limits can be applied to a single submission or a sum of multiple events.

- Thresholds for subsets of users can be defined as required.

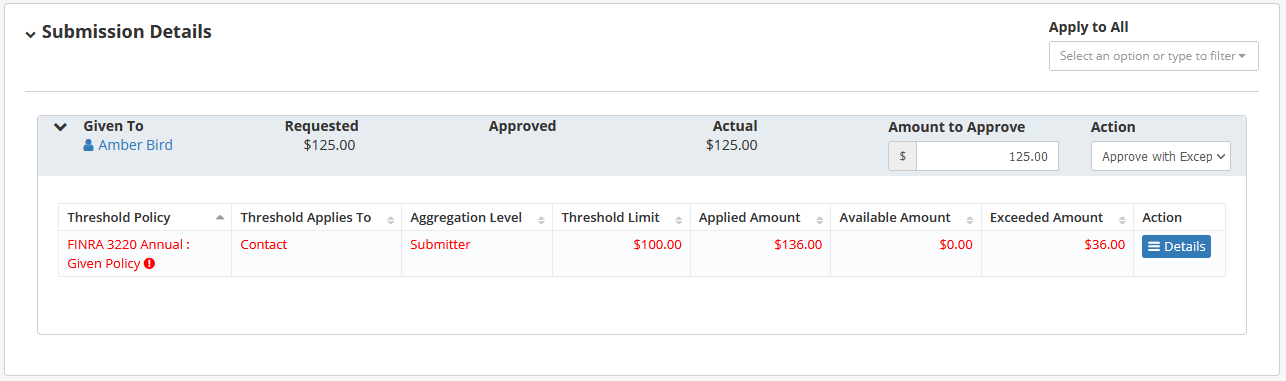

A firm customizes thresholds based on company policies and regulatory limits. In doing so, it can configure multiple thresholds by category, each with its own limit aligned to the firm’s corresponding policy or regulatory rule.

After the firm implements the solution, the system will calculate totals against firm-defined thresholds. If a threshold is exceeded or a submission would violate policy, the solution will automatically alert designated users.

If the threshold is not exceeded, a submission can be automatically approved, if a firm should choose to utilize the auto-completion capability. Users are presented with visual indicators for violations, such as when the amount exceeds the threshold or approved amount.

When thresholds are reviewed, overages are highlighted in red. Warning messages appear when totals are within a designated percentage of thresholds.

Conclusion

Complying with FINRA Rule 3220 does not have to be challenging. With RegEd’s Gifts, Gratuities and Contributions solution, you can set your rules and let the system do the work for your team.

If you are a RegEd client that would like to learn more about automatically aggregating gifts and gratuities to more efficiently comply with FINRA Rule 3220, please reach out to your Customer Success Manager.

If you do not currently use RegEd’s Gifts, Gratuities & Contributions solution, please contact sales@reged.com to learn more.

About RegEd

RegEd is the market-leading provider of RegTech enterprise solutions with relationships with more than 200 enterprise clients, including 80% of the top 25 financial services firms.

Established in 2000 by former regulators, the company is recognized for continuous regulatory technology innovation with solutions hallmarked by workflow-directed processes, data integration, regulatory intelligence, automated validations, business process automation, and compliance dashboards. The aggregate drives the highest levels of operational efficiency and enables our clients to cost-effectively comply with regulations and continuously mitigate risk.

Trusted by the nation’s top financial services firms, RegEd’s proven, holistic approach to RegTech meets firms where they are on the compliance and risk management continuum, scaling as their needs evolve and amplifying the value proposition delivered to clients. For more information, please schedule a consultation.