|

By Mark Mashewske, Senior Product Manager, Advertising Review, RegEd |

|---|

Already at an intense level, financial services advertising is becoming even more competitive as companies ratchet up spending in a rapidly recovering economy.

But companies cannot spend their way to success when everyone spends more than they did during the COVID-19 pandemic. Rather, with more than $40 billion and climbing spent on financial services advertising spent annually, 1 the race to grow assets under management depends on speed rather than spend. The firms that reach customers first win.

With firms’ goals for growing assets under management at stake, efficient and effective advertising review processes are essential for seizing competitive advantage. Fortunately for today’s firms, there has never been a better time to improve compliance while speeding time-to-market thanks to advanced technologies and intelligent capabilities including AI.

The degree to which a firm benefits from these technologies depends on the expertise of the vendors it chooses and the extent to which they leverage data. Top broker-dealers have distanced themselves from competitors by working with RegEd because we are unmatched in expertise and data.

Like with previous advancements in regulatory technology, RegEd will lead the way in improving compliance through intelligent capabilities.

No RegTech provider has delivered an advertising review solution for as long as RegEd or has done so as extensively. Our Advertising Review solution has processed millions of reviews, giving us experience with more data than anyone else in the industry by a large margin.

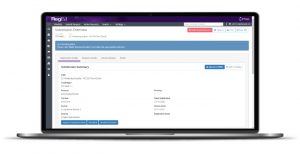

RegEd’s Enterprise Advertising Review is the most widely adopted solution among the nation’s broker-dealers due to its advanced capabilities. As the advertising review process is accelerated by technology-assisted review capabilities, reviewers spend less time reading and annotating content, ultimately providing the ability for certain submissions to be automatically reviewed and approved.

We help clients win by helping them stay ahead — especially when competition intensifies. RegEd’s Enterprise Advertising Review delivers the advanced technology firms require to work smarter and faster and reach customers sooner. Get there fast and get them first.

Advertising Review’s intelligent review and assisted work processes:

Automatically identify potentially problematic keywords, phrases, and images

Automatically identify potentially problematic keywords, phrases, and images- Automate mundane, manual tasks

- Streamline disclosure management, ensuring accuracy, consistency, and compliance

- Free resources to focus on high-value work

- Provide more effective data-mining, synthesis, and analysis

- Protect financial professionals and their firms against non-compliance risk

Armed with advanced technology and regulatory intelligence, compliance professionals are becoming even more valuable, enabling their firms to reduce review times, increase review volumes, and ensure consistency.

Advertising Review’s deep functional capabilities and advanced technology:

- Reduce compliance review time by 50%

- Reduce human intervention in 70% of submission reviews

- Eliminate NIGOs and increase first-touch approvals by 80%

- Achieve 100% Compliance with 17(a)-4

Renowned for consistent compliance technology innovation, RegEd continues to drive the highest levels of operational efficiency to enable clients to cost-effectively comply with regulations and continuously mitigate risk. Our clients stand on the shoulders of the experience of the largest broker-dealers in the industry, embedding industry best practices powered by market-leading solutions.

We help clients win by helping them stay ahead – especially when competition intensifies. Advertising Review delivers the advanced technology firms require to work smarter and faster and reach customers sooner. Get there fast and get them first.

1 WARC: Here’s How Financial Services Companies Invested Their Ad Dollars Last Year; Oct. 2019