The financial industry is facing a shift in how firms manage and monitor Outside Business Activities (OBAs), especially in light of the proposed consolidation of FINRA’s OBA and PST (Private Securities Transactions) rules. While much has been discussed about the structural and supervisory changes this consolidation may bring, one aspect that’s been less explored, but is drawing increasing scrutiny, is the monitoring of conditions placed on approved OBAs.

Conditional Approvals: A Growing Focus of FINRA Inquiries

Anecdotal evidence suggests that FINRA is beginning to ask firms a pointed question: If you approve an OBA with conditions, how are you ensuring those conditions continue to be met?

This may seem straightforward, but for many firms, it’s a blind spot. Firms may be dealing with the cumbersome process of manual tracking or simply rely on representatives to follow the rules and remain in compliance. This often exposes the firm to unnecessary risk, which is driving the increase in regulatory scrutiny around risk management.

Understanding the Risk in Conditional OBAs

Not all OBAs carry the same level of risk. FINRA has signaled increased attention to OBAs that present potential conflicts of interest or exposure to sensitive financial information.

Examples include:

- Serving on a board of directors, with conditions such as abstaining from votes that may create a conflict of interest.

- Operating a side investment-related business with the caveat that no securities are recommended or sold to firm clients.

- Public speaking if topics are pre-approved as well as stating that confidential information may not be divulged.

In these cases, approval is granted with strings attached. But those strings can fray over time unless there is a mechanism to monitor them.

The Regulatory Burden on Member Firms

Under the proposed OBA + PST rule consolidation, member firms have a clear obligation: they must consider whether placing conditions on OBA approvals is advisable, and more importantly, they must track whether those conditions are being honored. It’s not enough to document the approval – you must supervise the conditions. That’s where many firms are falling short.

How RegEd Can Help

RegEd’s Outside Business Activities solution was designed with these supervisory challenges in mind. RegEd tracks the OBA and/or PST and the associated conditions separately, instead of bundling the conditional approvals as a single data point. This enables:

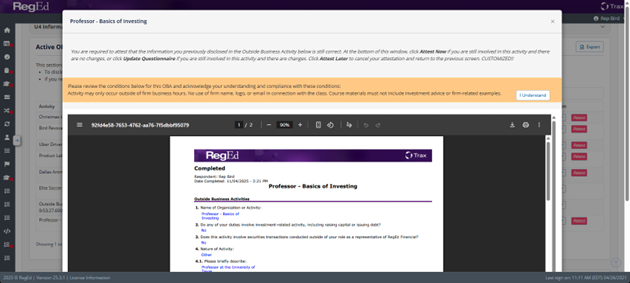

- Transparency and Accountability: Conditions display clearly on dashboards for both reviewers and representatives, ensuring employees understand the limitations or responsibilities tied to their external activities.

- Attestation integration: Representatives are prompted to attest to the conditions directly during scheduled attestations – ensuring continued compliance in a feasible and effective manner.

- Supervision support: Reviewers can quickly assess which OBAs carry conditions and whether those conditions are being met. Tracking conditions also provide consistent standards and fairness across similar cases.

- Regulatory compliance: Firms can demonstrate their review process, not only upon initial approval but throughout the duration of the Outside Business Activity or Private Securities Transaction.

This level of granularity not only supports compliance but enhances supervisory insight – something FINRA is increasingly expecting firms to demonstrate.

Attestations: A Critical Layer of Oversight

Attestations are a powerful tool to reinforce ongoing compliance. RegEd enables firms to build flexible attestation programs – quarterly, semi-annually, or annually – based on risk profiles and firm policy. With attestations:

- Registered representatives are reminded of existing conditions and prompted to report any OBA changes.

- Representatives who are no longer active in an OBA can be prompted to inactivate stale records.

- Admins can quickly generate U4 amendments via RegEd’s FINRA API integration for a seamless compliance workflow.

- Reviewers receive side-by-side comparisons of previous and current disclosures, streamlining their review and decision-making process.

And importantly, the attestation doesn’t just confirm what OBAs a representative has – it also verifies that they continue to have none, a critical check often overlooked.

The Bottom Line: You Can’t Monitor What You Don’t Track

The new rule structure formalizes what FINRA has long expected: if you approve an OBA with conditions, you must ensure those conditions are followed. Tracking them manually – or worse, not at all – opens the door to supervisory gaps and regulatory risk.

RegEd’s solution is purpose-built to meet this need. With transparent dashboards, automated attestation workflows, and condition-specific tracking, firms gain control over one of the most complex aspects of OBA oversight. Schedule a consultation to explore how our solution can enhance your OBA supervision program to help your firm stay compliant, efficient, and audit-ready.

About RegEd

RegEd is the market-leading provider of RegTech enterprise solutions with relationships with more than 200 enterprise clients, including 80% of the top 25 financial services firms.

Established in 2000 by former regulators, the company is recognized for continuous regulatory technology innovation with solutions hallmarked by workflow-directed processes, data integration, regulatory intelligence, automated validations, business process automation and compliance dashboards. The aggregate drives the highest levels of operational efficiency and enables our clients to cost-effectively comply with regulations and continuously mitigate risk.

Trusted by the nation’s top financial services firms, RegEd’s proven, holistic approach to RegTech meets firms where they are on the compliance and risk management continuum, scaling as their needs evolve and amplifying the value proposition delivered to clients. For more information, please visit www.reged.com.